The SaveLend platform offers its own risk rating model to provide investors with an assessment of individual real estate loans (hereinafter referred to as "projects") and their risk profile in comparison to other projects on the platform. By using SaveLend's risk classification model, investors can easily gain an understanding of the projects' potential risks and opportunities.

The model analyzes and assesses each project based on various factors and criteria. By carefully reviewing the project's characteristics, such as cash flow, security, the contractor, capital structure and project stage, SaveLend (SBL Finans AB, which is a provider of crowdfunding services in SaveLend) can calculate risks for the project and assign a risk rating from A to E. If a project receives a risk rate of F, it gets rejected.

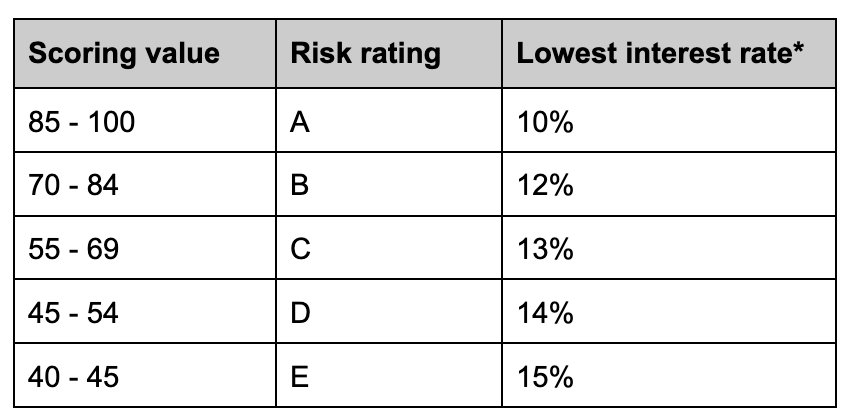

The risk classification model is based on five criteria that are individually rated on a scale from 1 to 100. These ratings are then summed to obtain an aggregate scoring value for the project, which translates into a risk rating between A and E according to the table.

A: Highest risk rate. Indicates a low risk that the borrower will not be able to meet its financial obligations.

B: High risk rate but with a slightly higher risk level than A. Still considered low risk.

C: Good risk rating, but with an increased risk compared to risk rating B. It is still considered a good credit rating, but not the highest level.

D: Acceptable risk rating, but with a progressively increased risk compared to the above risk rates. The borrower may, for example, be more sensitive to economic fluctuations and an uncertain market.

E: A higher credit risk compared to the above risk rates as the borrower is deemed to be more vulnerable to changes in economic conditions or industry-specific challenges.

Lowest interest rate - the lowest rate you typically see for each risk rating. However, there may be exceptions depending on local market conditions, and sometimes you can find loans with both higher and lower interest rates.

* "Lowest interest rate" is based on the reference interest rate STIBOR 90 days with a risk rating surcharge based on each individual risk rating. SaveLend reserves the right to change the lowest interest rate based on the company's view of the market and the outside world without being informed in advance.

By always valuing underlying information in the same way, it gives investors the opportunity to make informed investment decisions and diversify their portfolio based on different risk profiles. In this way, investors can shape an investment strategy that suits their risk tolerance and goals. SaveLend strives to offer a transparent and reliable risk rating that promotes a responsible investment environment where investors can make well-informed decisions and understand the risks associated with each project.

The model provides an overall assessment of the level of risk and serves as support for decision-making, but it does not constitute an absolute truth. Even if a project has a favorable risk rating, credit losses may occur, just as a project with a less favorable rating will not necessarily result in losses. Therefore, it is crucial that investors do not rely solely on the risk rating, but also conduct their own careful evaluations of the project's fundamentals as well as the business model, the team's skills, market trends and other relevant variables that may affect the project's success.