You can start SaveLend Fixed in SEK for 12 or 24 months and have them running at the same time. Note that the number of accounts is limited every month and it is the "First Come – First Served Principle" that applies. When an account is fully subscribed you will see "Full" and it will not be possible to select that specific account.

When you open your first Fixed Interest Account, we automatically create a transfer depot for you. This depot will be used to temporarily store the capital to be placed in your Fixed Interest Account.

This depot is also used to get your money paid out when the term for your SaveLend Fixed account is over. You can then either withdraw them or reinvest in a new Fixed Interest Account or Strategy. You have the option of moving money from the transfer depot until the last day before the activation date of your SaveLend Fixed account. You can also start a monthly savings for your transfer depot. This money will remain uninvested until the day SaveLend Fixed is activated.

How do I start a SaveLend Fixed account as an existing investor?

If you already have an account with SaveLend with an active savings strategy, you can get started with SaveLend Fixed by:

1). Log in to your account and go to "Depot overview". There you can see a new box for SaveLend Fixed. Click on "Create account":

2). Enter the preferred amount, select the term and start date from the suggested options. Then click on "Continue".

How do I start a SaveLend Fixed account as a new investor?

To start saving with SaveLend Fixed on SaveLend's savings platform, create an account here and then select SaveLend Fixed - Fixed Interest Account as follows:

1). Scroll down and click on the "Select" button for "SaveLend Fixed".

2). Enter the preferred amount, select the term and start date from the suggested options. Then click on "Continue".

3). Complete your onboarding by entering your phone number and KYC (Know Your Customer) information.

4). The final step to prepare your Fixed Interest Account is to make a deposit.

How do I make a deposit to Fixed Interest Account?

To ensure the activation of your account on the selected start date, you must transfer the selected amount to the transfer depot.

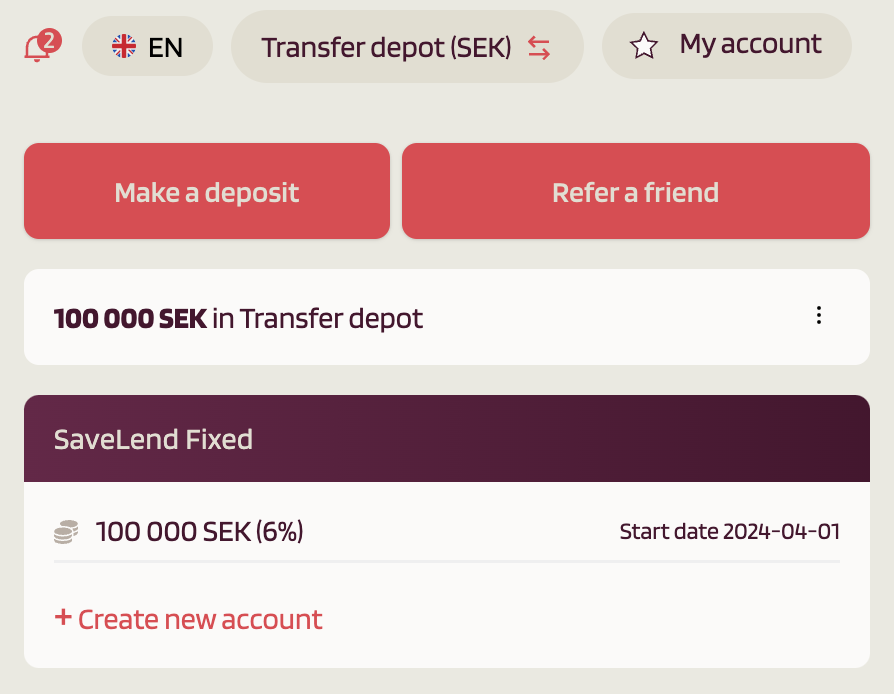

Click on "Make a Deposit" and select "Fixed Interest Account" to transfer the amount to the "Transfer Depot". As usual, you can use Swish, Trustly, bank transfer or move funds from other depots (applies only to existing customers). The amount you entered will then appear in the transfer depot as follows:

Please note that it takes 1-2 banking days for your money to appear in the transfer depot if you choose to make a deposit via bank transfer.

You can choose to cancel activating your Fixed Interest Account until one (1) banking day prior to the activation date by withdrawing available money from the Transfer depot.

Note that you cannot make any changes regarding the amount and period (term). If you would like to change the amount, please contact our customer support.

How is interest calculated for SaveLend Fixed?

You cannot see which loans the money in SaveLend Fixed is invested in, but SaveLend ensures that it provides a fixed 6% return when the term is over. The terms for SaveLend Fixed are included in our standard terms for automatic investments, which you agree to when creating an account.